How Accurate January Financials Set the Tone for the Rest of the Year

January is more than just the first month of the calendar year, it’s the foundation for your business’s financial health. Accurate financials at the...

To us it's simple...

"Do things the right way. For the right reasons. Good things will follow."

3 min read

Rafael Vidal, President & Co-Founder, ProNexus, LLC

:

Aug 4, 2022 3:07:55 PM

Rafael Vidal, President & Co-Founder, ProNexus, LLC

:

Aug 4, 2022 3:07:55 PM

As a CPA and Co-Founder/Partner of ProNexus, I am often asked if our firm can help our clients fill a vacant CFO or Controller position on an interim and/or full-time basis. I always reply with a question: “What’s the nature of the vacancy and which role are you seeking to fill?” Typically, the response is, “There’s a difference?” Hiring the right accounting staff plays a key role in improving your profits.

The next question we ask is: “What is the scope of work to be performed?” Often, the response is, “Hands-on, closing the books, preparing financial statements, and helping us use this information to make business decisions.”

Yes, there certainly is a difference in roles and scope of tasks to be performed. It is the equivalent of asking if you want your family doctor or a cardiologist to perform open heart surgery. Indeed, each has medical training, but their expertise and associated skills are very different.

As with any position, the type of organization, culture, cash flow, and many other variables dictate the kind of role you need to hire. Considering this, the distinction between each role in the accounting department breaks down into salary range and key tasks:

Given the cost of staffing an entire accounting department, many businesses choose not to hire all roles and seek someone to cover some or all of the roles in one. Often, a small business will try to draw the interest of a seasoned professional with higher level titles (CFO or Controller), pay them 10-20% below market rate, and expect them to cover all duties above clerical. The typical result is a deficiency in one or all the required roles that quickly results in burnout and employee dissatisfaction. Good people don’t take less money to perform multiple duties or work below their capabilities.

A better solution is to leverage a combination of outsourced services and in-house staff, with each person in the right role. With today’s technology, a hybrid on-premise and outsourced solution is a viable strategy to maximize performance across all accounting roles.

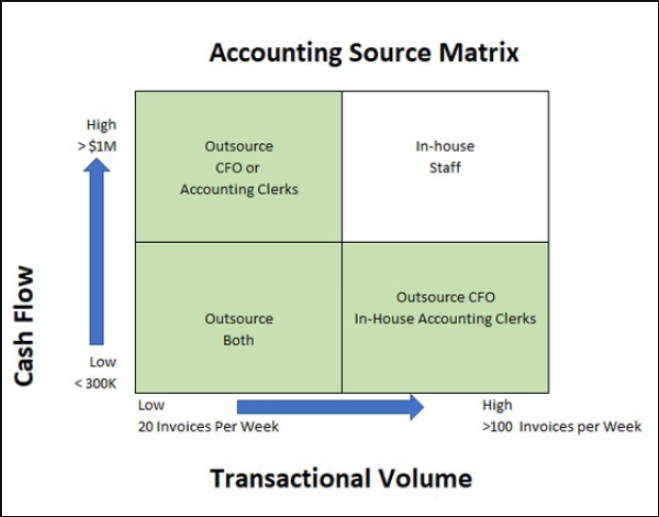

A business’s annual revenues and transactional volumes (number of invoices/payables/purchase/orders, etc.) typically dictate which role to hire and which role to outsource.

In my experience, the following graph fairly represents the outsourcing/staffing combinations based on typical business workflows:

As a rule of thumb, if your business is generating less than $300K of cash flow per year, you should look hard at outsourcing some of your accounting functions.

Is outsourcing the right choice for your business?

Take our 8-question survey to find out.

.png?width=200&name=ProNexus_Square_Logo_-_Tagline_copy-removebg-preview%20(1).png)

January is more than just the first month of the calendar year, it’s the foundation for your business’s financial health. Accurate financials at the...

As businesses step into the first quarter of a new year, many owners uncover accounting errors from the previous year that can impact tax filings,...

The start of a new year isn’t just about resolutions—it’s the perfect opportunity for business owners to get their financial records in order....

A right of use asset, or ROU, is a lessee’s right to use an asset over the course of a lease. More formally stated, an ROU asset is any non-monetary...

Outsourcing any part of your business is a great way to keep overhead costs low, save time, and utilize outside expertise. But outsourcing also...

Not sure if your organization needs outsourced finance or consulting support? Watch for these warning signs: